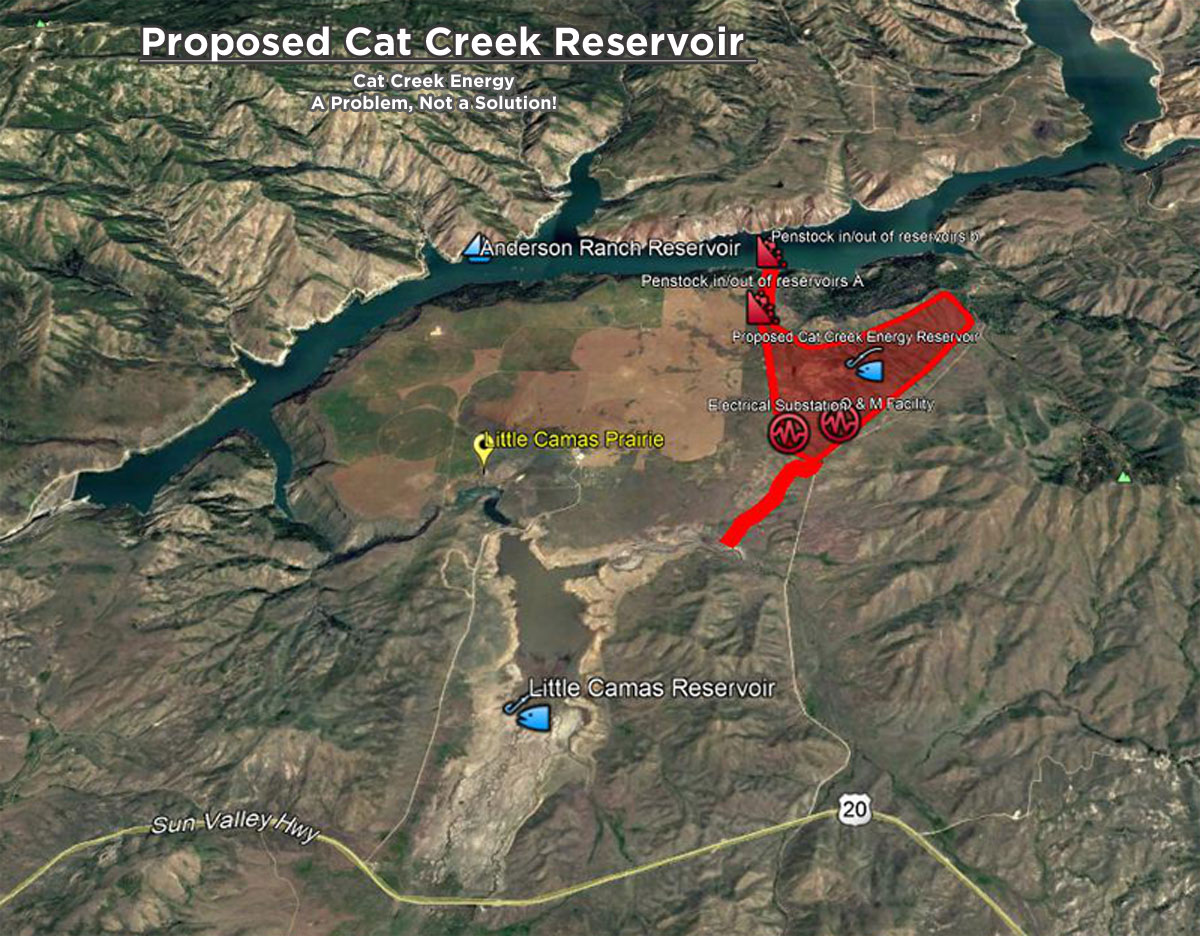

Anthony Jones was retained by the S Bar Ranch to evaluate Cat Creek Energy’s Motion for Protective Order regarding its planned pumped hydroelectric storage facility on Little Camas Prairie in Elmore County, Idaho. That planed pumped hydroelectric storage facility entails creating a new reservoir on the bluffs about 800 feet above Anderson Ranch Reservoir. The proposed water right that would be used to fill the Cat Creek Energy Reservoir currently doesn’t exist.

Mr. Jones researched the Cat Creek Energy idea of building the pumped hydroelectric storage facility, plus a large scale solar and wind turbine complex. His conclusions tell us the financial viability of the Cat Creek Energy project along the Highway 20 Corridor in Elmore County is questionable at best. Mr. Jones also suggests Cat Creek Energy, LLC is trying to keep critical project information and documentation from public scrutiny under a guise of a proprietary exemption. This cannot be allowed to happen.

Read Mr. Jones’ 12 talking points below.

Download the full Legal Doc from Anthony Jones to Cat Creek Energy's Motion for Protective Order - June 30, 2020 legal document that is partially included below.

###

Declaration of Anthony M. Jones in Support of SBar Ranch, LLC and the District at ParkCenter, LLC’s Response to Motion for Protective Order and Renewed Motion for Rule 40.05b Order for Applicant to Submit Complete Rule 40.05 Information

ANTHONY M. JONES, being first duly sworn, deposes and says:

1. I hold a B.S. degree in economics from Idaho State University and an M.A. degree in

economics, from the University of Washington.

2. As detailed in my curriculum vitae attached hereto as Exhibit A, I have substantial

experience and expertise in the field of energy project economics.

3. Currently, I am the Principal of Rocky Mountain Econometrics, a consulting energy

economics firm in Boise, Idaho.

4. I was retained by SBar Ranch, LLC and The District at ParkCenter, LLC to evaluate

Cat Creek Energy LLC’s claims of proprietary and trade secret information in its June 16, 2020,

Motion for Protective Order and associated Declarations in this proceeding. In connection with

my work, in addition to reviewing the Motion for Protective Order and associated Declarations, I

also have reviewed Cat Creek’s Applications for Water Right Permit Nos. 63–34403, 63–34652,

63–34897 and 63–34900, Idaho Code 42–203A(5)(d), Idaho Water Appropriation Rule 40.05(f)

and Shokal v. Dunn, 109 Idaho 330, 707 P.2d 441 (1985), as well as other publicly available

information and pertinent materials available to me.

5. I reached the opinions presented here by applying accepted methodology in the field

of energy economics. The opinions expressed here are my own and are based on the data and

facts available to me at the time of writing. I hold the opinions set forth here to a reasonable

degree of economic science certainty.

6. The Cat Creek project will be located geographically in Idaho Power Company’s

(“IPC”) territory and will connect to the Western Grid. When generating, it will produce roughly

25% as much power as does IPC total. It will produce more power than Brownlee Dam, IPC’s

largest hydro project and nearly as much as IPC’s largest coal plant, Jim Bridger.

7. When pumping water back to its reservoir, the Cat Creek project will consume even

more power than it generates, comprising approximately 25% of IPC’s total firm load, roughly

equivalent to the load of the Treasure Valley, on top of IPC’s existing firm load.

8. The Pacific Northwest, where Cat Creek’s project will be located, has the most

intensively developed hydroelectric energy industry in the United States, perhaps the world. The

major players, Bonneville Power Administration, Avista, IPC, and Pacificorp, all have hydro

projects that also provide energy storage that can be used for load shaping and energy

storage. They all have programs in place to provide, both for themselves and for independent

power providers, the exact same service CCE is proposing.

9. Pumped storage is reviewed on page 54 of IPC’s most recent 2019 Amended

Integrated Resource Plan (“IRP”). In the IRP, IPC gives pumped storage an economic thumbs

down, noting, “Historically, the differential between peak and off–peak energy prices in the

Pacific Northwest has not been sufficient enough to make pumped storage an economically

viable resource.” (Page 54 of IPC’s most recent IRP is attached hereto as Exhibit B.) In the IRP,

IPC puts the levelized cost of pumped storage at around $175 /MWh. That cost compares

unfavorably with open market prices averaging less than $30/MWh and load shaping service

from the major players for less than $50/MWh.

10. Given that the process of storing energy via the pump storage process has been

developed and well understood for decades; that the necessary pump–turbines, control

mechanisms, etc. are commercially available from multiple vendors offering nearly identical

performance criteria; that at least 24 other pump–storage projects, many of similar sizes and

configurations, all connected to the same Western Grid, all dedicated to serving the same daily

mismatches in the supply and demand curves, are currently working their way through the

application process; that competition for and supply of investment funding is universal and

seemingly instantly balancing, nothing presented suggests that CCE’s solution to energy storage

is an improvement on the same process studied and shelved by the region’s major utilities or

superior to the other projects being promoted in other areas. One would expect that a dramatic

technological improvement to pumped storage would be supported by one or more patent

applications.

11. Bottom line, against this backdrop, Cat Creek Energy needs to be able to establish

that it will be able to cost effectively participate in this competitive energy marketplace. If there

is no assurance that its project will be economically viable, there can be no reason to expect that

it is reasonably probable financing can be secured.

12. At approximately 5 years away from operation, as I understand Cat Creek Energy

claims to be based on a review of its project timeline provided as CCE-X-00039, it should be

able to provide the full terms of its capital funding arrangements, including the amount and terms

of debt commitments, the amount and terms of equity commitments, and the interest rates,

amortization schedules, provisions for default, anticipated cash flows, prospective balance

sheets, the cost and income relationships associated with CCE’s wind, solar, pump–storage,

irrigation, municipal water, and irrigation district operations, etc., for the life of the project. The

only potentially confidential items that may need redaction would be the identity of the parties

committing to provide the capital. This redacted information should be provided to the Hearing

Officer, however.

I declare under penalty of perjury that the foregoing is true and correct.

DATED THIS 30th day of June, 2020.

~ signed ~

Anthony M . Jones

###

You can download the full legal document at https://catcreek-energy.com/download/1093/

Thanks for any support you can offer in getting the Cat Creek Energy project sent back to the Elmore County Commissioners for an honest reevaluation of the entire project. The people of Elmore County, Idaho deserve better.